Lucid Carbon Pty Ltd was established specifically to invest in opportunities which arise due to the historic push for a net zero carbon emission future.

Recent agreements have seen most major economies sign up to have their countries with net zero emissions somewhere between 2030 and 2060. This global action plan aims to limit the global warming caused by climate change to 1.5 degrees.

Lucid Carbon is the holder of an Australian National Register of Emissions Unit (ANREU) account where all Australian Credit Units are held and recorded by the government regulator. Lucid Carbon is also a member of RIAA (Responsible Investment Association Australasia)

The Investment Opportunity

Whilst some still argue about the science of climate change and/or if it is caused by humankind, most of the world now seems to agree on the seriousness of the global warming the world has been experiencing in the past few decades. Global temperature metrics have increased and there has been significant evidence of more extreme weather activity.

Regardless of one’s personal views, there is enough momentum behind the climate change industry that all countries, particularly wealthy developed ones, will need to sign on to a net zero emissions policy or face being ostracized by the climate-conforming countries of the world. So far, 196 countries have signed onto the Paris accords, a legally binding treaty on climate change. The Paris Agreement aims to hold average net temperatures to 2 degrees above that of the pre-industrial levels and pursue efforts to limit the temperature increase to 1.5 %.

Purely from an investment standpoint, the climate change movement is impossible to ignore. With trillions of dollars to be funnelled into the broad investment thesis, an investor will ignore the sector to their detriment. The Commonwealth Bank of Australia has estimated that AUD $2.5 – $3 trillion of investment will be required to meet this investment by 2050 in Australia alone.

A Truly Uncorrelated Asset Class

Idiosyncratic factors dominate the international carbon credit markets to such an extent that it renders macroeconomic factors as secondary.

The regulatory environment, political pressures, and net emission reduction targets mandated by the Paris Climate accord create ever-increasing demand for offsets. Add to this the increasing desire of the populace to act on climate change, meaning that even companies not required by regulation are under unprecedented pressure to reduce and neutralise their climate emissions.

These factors indicate that the Global Carbon markets are likely to be highly uncorrelated to Equities, Bonds and indeed to traditional commodities.

The Relevance from an Australian Perspective

Australia is ironically set to become a global focus of CO2 sequestration whilst the government is still committed to our traditional industries.

A long-term generational shift that will see Australia’s relationship with carbon turn from one of extraction via coal mining to one of sequestration via carbon capture. Just as Australia had an abundant resource of Coal to extract from the ground it has similar capacity to return that Carbon to its forests, plants, mangroves and soils.

Australia’s large land mass and low population density provide a significant comparative advantage over many other developed nations to develop and export high-quality Carbon Credits. If managed intelligently, Australia’s abundance of carbon sequestration capacity.

Australia’s resource rich land could combine seamlessly with renewable energy to develop projects like green hydrogen, green steel and green aluminium. With sufficient investment and motivation Australia’s economy could morph a world leader in the green economy.

Timing

Whist there has already been significant investment in the space much more is needed Australia is to meet our COP 26 Climate change obligations.

Unfortunately, the market is not yet comprehensively understood by investment professionals and the public at large. There are still severe limitations on what banks and other financial institutions are willing to finance. This leads to a significant disconnect within the industry whereby demand for new projects is increasing whilst the normal investment banking facilities are still lagging.

The above disconnect will not last, which is why we strongly believe is the ideal time to invest using a pooled structure such as a hedge fund before the banks and other financial institutions become more comfortable with the space and start lending larger sums to the industry participants.

Change of Government

The latest Australian federal election saw a change of government and an unprecedented increase in support for environmentally progressive candidates. Whilst the Green party increased their vote, the rise of the “teal” independents particularly significant as it demonstrates that normally conservative voters are looking for green, but right leaning representation in government.

Under the new Labor government, Australia has committed to an emissions reduction target of 43 percent from 2005 levels by 2030 and net zero emissions by 2050. They have also appointed an independent panel to review the integrity of ACCUs under the ERF.

The Panel will provide a report to the government with recommendations by 31 December 2022. We anticipate a tightening of the criteria for issuing ACCUs, significant changes to the safeguard mechanism and a possible minimum price set for carbon emissions. This will likely lead to near term upwards pressure on the price of ACCUs.

All indications are that the review will recommend the implementation of an integrated farming methodology for issuing ACCUs. We are confident that this will lead to increased opportunities for our projects.

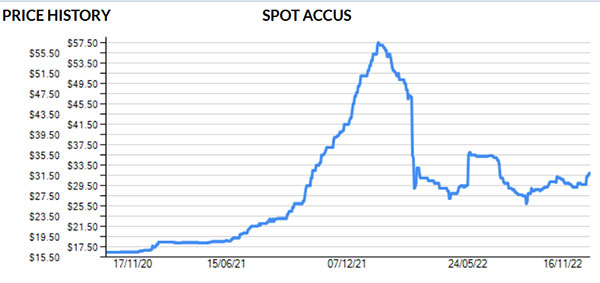

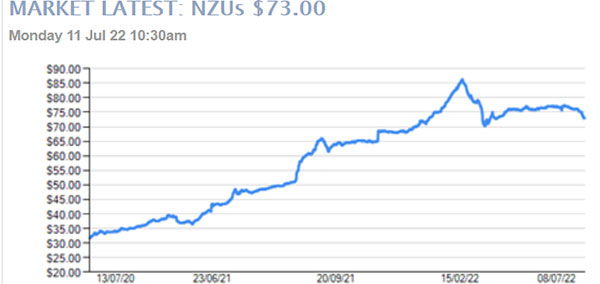

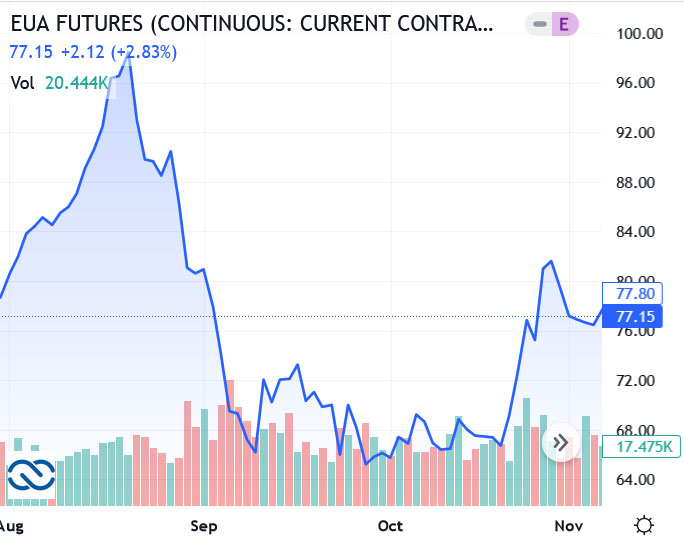

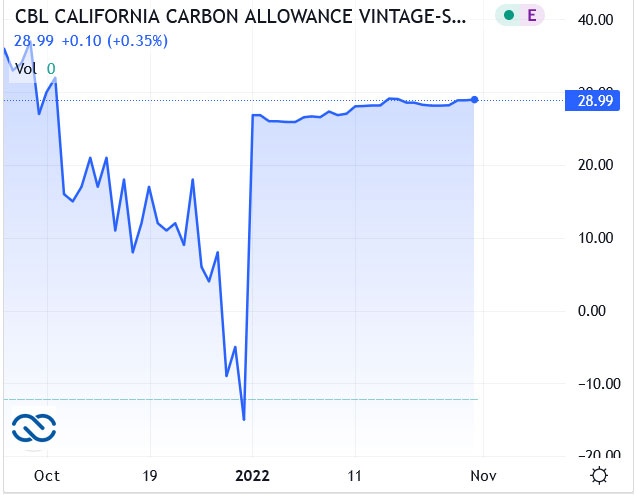

World Carbon Prices

The volatility of the Australian carbon credit market is of some concern; however, we feel it also creates a great deal of opportunity. The Lucid Carbon team has over 100 years of trading experience across a diverse range of asset classes. We aim to use various derivative strategies such as long puts, short calls and forwards to take advantage of the prevailing market conditions.

We have sanity-checked our medium-term bullish view and are confident that these rapid movements have been due to macro factors and regulatory changes. The long-term bullish uptrend is intact for the ACCU and world carbon markets.

We acknowledge the risk involved in trading such an asset class and, more importantly, investing in the assets where the payoffs are spread over a long period. To this end, we are very particular in the projects we will invest in, and each ACCU’s effective cost will be our primary focus when making our investment decisions.

Investment Strategies

Investment Strategy

Lucid’s initial strategy was to secure a core position in ACCUs (Australian Carbon Credit Units) through on-market purchases, forward contracts, long call options / short put options, carbon project financing and carbon project origination.

Our initial investment thesis is simple, i.e., that ACCUs are significantly undervalued compared to their international peers. We anticipate numerous catalysts likely to result in a rerating of the ACCU price. We believe an investment in ACCUs provides an asymmetric return profile at current prices.

The founding partners have been accumulating ACCU exposure whilst the fund structure has been established. These positions will be rolled into the Fund. As such, the founding partners will be the initial investors in the Fund.

The Fund has signed a financing deal for one project (see details below) and is advanced in the due diligence on numerous other HIR (Human Induced Regeneration) projects.

Intermediate Investment Strategy

The Fund will invest in a variety of asset classes which directly or indirectly contribute to the decarbonisation agenda across both the Australian and International markets. The Fund will look for both assets with high capital growth potential as well as yield based investments to moderate directional risk.

As the global carbon market matures, we anticipate numerous opportunities for ground level investment in carbon sequestration projects, particularly in developing countries. We have people on the ground in South East Asia actively looking at potential projects.

Engagement with Australian Indigenous communities as essential to our strategy. Joint ventures with indigenous organisations significantly contribute to co-benefits attributable to the projects.

Concurrent Investments

We have kept our investment mandate quite broad for several reasons.

- Due to the nature of carbon generation projects and the long lead time with pre-feasibility reports, regulatory hurdles, government approvals, indigenous engagements, etc.

- The pace at which new technology is likely to be developed means that being nimble enough to invest in early stage projects or companies be beneficial for potential returns.

- We realise the importance of not having too much idol cash whilst we wait for the required work to be completed.

Our aim for each investment is to uphold our ESG responsibilities and work towards reducing, sequestering, storing, or mitigating carbon emissions or achieving some other desirable environmental goal.

Projects

Station Regeneration Project

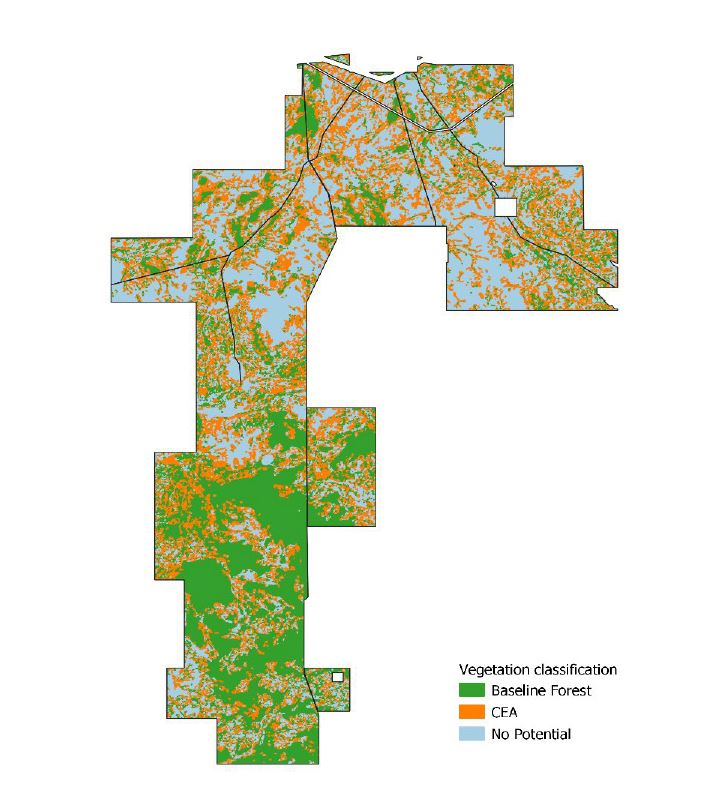

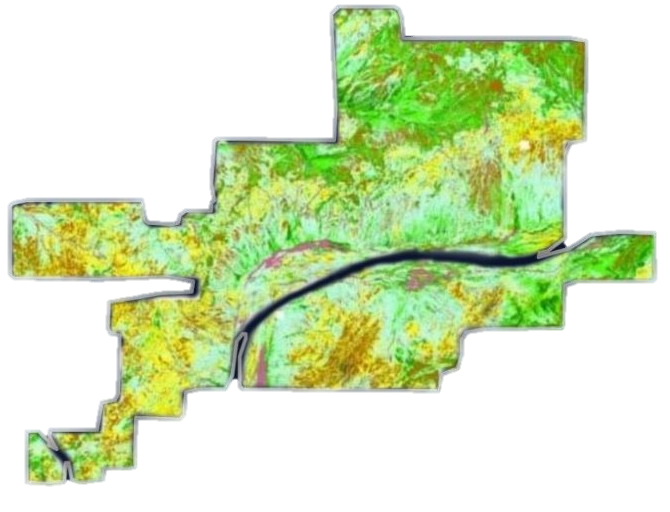

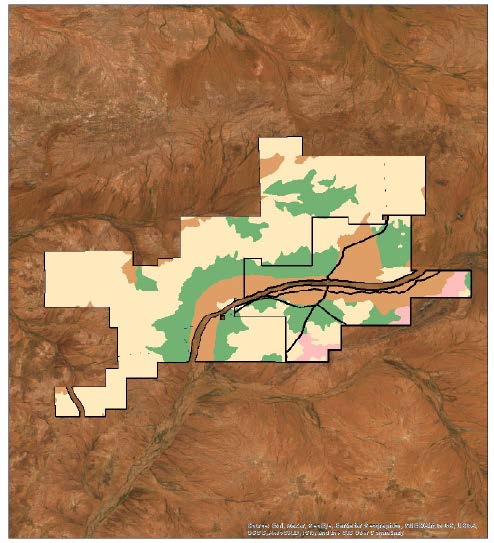

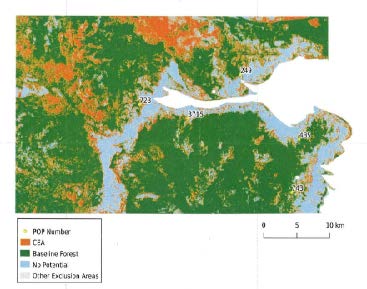

Project 1 is a Human-Induced Regeneration Project that aims to sequester carbon by allowing native vegetation to regenerate on land where grazing pressure has been sufficient to suppress regeneration. The project has been developed in compliance with the Carbon Credits (Carbon Farming Initiative) (Human-Induced Regeneration of a Permanent Even-Aged Native Forest—1.1) Methodology Determination 2013 Compilation no.3 (“the HIR methodology”).

For regenerating vegetation to achieve forest cover (technically defined as 2m or more in height and 20% canopy cover), it is necessary to manage the timing and extent of grazing and any risks that may have an adverse impact on carbon stocks.

Date of Contract

December 2018

Method:

Carbon Credits (Carbon Farming Initiative) (Human-Induced Regeneration of a Permanent Even-Aged Native Forest – 1.1) Methodology Determination 2013.

Method Type:

Vegetation

Project Location

Western Australian

Property Size

90,000 hectares

Station Regeneration Project

Up to 350,128 hectares may be eligible, under the Human Induced Regeneration Method (HIR), to undertake carbon farming on Project 2 Station. However, we are adopting a more conservative figure of 141,234 hectares until further fieldwork and mapping are completed.

An estimated 1,777,160 tonnes of carbon over 25 years will likely be generated based on a conservative estimate of carbon yield averaging 12.58 tonnes of CO2e per hectare over the 25-year project life.

Date of Contract

January 2021

Method:

Carbon Credits (Carbon Farming Initiative) (HIR of a of a Permanent Even-Aged Native Forest – 1.1) Methodology Determination 2013.

Method Type:

Vegetation

Project Location

Western Australian

Property Size

450,000 hectares

Station Regeneration Project

Project 3 is a Human-Induced Regeneration Project that aims to sequester carbon by allowing native vegetation to regenerate on land where grazing pressure has been sufficient to suppress regeneration. The project has been developed in compliance with the Carbon Credits (Carbon Farming Initiative) (Human-Induced Regeneration of a Permanent Even-Aged Native Forest—1.1) Methodology Determination 2013 Compilation no.3 (“the HIR methodology”).

For regenerating vegetation to achieve forest cover (technically defined as 2m or more in height and 20% canopy cover), it is necessary to manage the timing and extent of grazing and any risks that may have an adverse impact on carbon stocks.

Date of Contract

July 2018

Method:

Carbon Credits (Carbon Farming Initiative) (Human-Induced Regeneration of a Permanent Even-Aged Native Forest – 1.1) Methodology Determination 2013.

Method Type:

Vegetation

Project Location

Western Australian

Property Size

130,000 hectares

The Team

The Lucid Carbon team has a wealth of financial markets, renewables, energy and funds management experience between them. Each has a genuine desire to achieve positive environmental outcomes whilst recognising that decarbonisation solutions need to be mindful of the importance of the mining and agricultural industries to the Australian economy.

We have a number of consultants on our books which will ensure we are doing all required due diligence for every project where we require subject matter experts.

Michael Cox

Founding Partner /

Chief Investment Officer

Michael is the Managing Director of Habitat Energy Systems a private company providing financial services to the renewable energy industry which he started in 2015.

Michael has been an independent derivatives trader since 2005. He has a wealth of experience trading a broad range of financial products.

Prior to Habitat, Michael was a derivatives trader at Marex Financial in the UK.

Michael holds a Bachelor of Commerce from the University of Canterbury, specialising in Financial Economics.

“Whilst I have always believed in the need to take climate change seriously, it wasn’t until I joined the Rural Fire Service and saw the nationwide devastation of the summer 2019/20 fires that it really hit home the need to act.”

Peter Fay

Founding Partner /

Chief Executive Officer

Peter has accumulated a wealth of financial markets experience since starting his career on the Westpac FX trading desk in the early 2000’s. The financial markets have provided the opportunity to work in Europe and Asia however has now returned to Sydney. Peter has traded a broad range of financial products focusing on Options, Futures and more recently small cap Australian equities.

Peter’s career has currently pivoted to the investment banking domain where he acts as director of Prime Broking Sydney with Singapore investment bank CGS-CIMB.

Peter holds a Bachelor of Economics from the University of Sydney, a Masters of Finance (FINSIA) and has completed the Henley Business School Hedge Fund Program.

“Having been raised in a regional town with a high unemployment rate and limited opportunities, I am excited about the prospect of creating new projects and providing new employment prospects in similar towns, particularly among indigenous communities. At the risk of sounding clichéd the potential Co-benefits of these carbon projects can be a game changer”

Nathan Young

Investment Committee /

Board Member

Nathan has over 20 years experience in financial markets. He is currently a portfolio manager for a Hong Kong based long only equity fund specialising in micro and micro/mid cap stocks.

Prior to this he was employed by a large Investment Bank in Prime Broking and a Sydney based Hedge Fund. His primary role at the hedge fund was to evaluated businesses and invest proprietary capital in Seed and pre IPO opportunities in the resource and technology space.

He holds a Bachelor of Commerce from The University of Melbourne and a Graduate Diploma in Applied Finance and Investment. He is also holds licenses with Hong Kong Securities and Investment Institute – Paper 1 and Representative type 9.

“Although investment in renewables has increased significantly in recent years, it is still well below what is required for the worlds stated decarbonisation goals. I am excited to work to bring innovative solutions to increase investment in the renewable and carbon mitigation space”

Dean Kleinschafer

Board Member /

Logistics Manager

Dean is Business Manager of Habitat Energy Systems, a private company providing financial services to the renewable energy industry. He has a wealth of experience dealing with renewable energy markets including the creation and trading of renewable energy certificates.

Dean has expertise in the regulatory and compliance space within the Australian carbon market and is key person on Habitat ANREU account.

Prior to Habitat, Dean was General Manager at Hydromet Corporation (precious metal recovery) and Operations Manager at Chempro NZ (3PL Logistics).

Dean has studied Supply Chain Management and holds a Diploma of Business from Swinburne University.

“We owe it to our children to find a solution to the massive threat of climate change. Working together we have a golden opportunity to promote prosperity and sustainability for future generations”

Environmental, Social and Governance Practices

Traditional Custodians

Lucid Carbon is committed to engagements with the traditional custodians in all projects on which we work. We aim to provide employment, education, environmental and economic benefits to the traditional custodians where ever possible.

We see significant opportunity in engaging with the various land councils and indigenous organisations throughout Australia to achieve mutually beneficial goals working on carbon generation projects.

Developing Nations

As with our Australian projects, we aim to see projects within developing nations where we can work with the local communities to develop high quality carbon credits whilst at the same time providing employment, environmental, education and economic benefits

Lucid Carbon is committed to implementing, monitoring and reviewing Environmental, Social and Governance (ESG) practices across the business and across assets managed by the firm. Lucid Carbon is a provisional signatory to the United Nations Principles of Responsible Investing (UNPRI). Lucid Carbon policy integrates these principles into investment considerations and processes.

Lucid Carbon is a corporate member or RIAA and are working with the organisation to have the fund as a certified responsible investment.